Business Insurance in and around Independence

Calling all small business owners of Independence!

This small business insurance is not risky

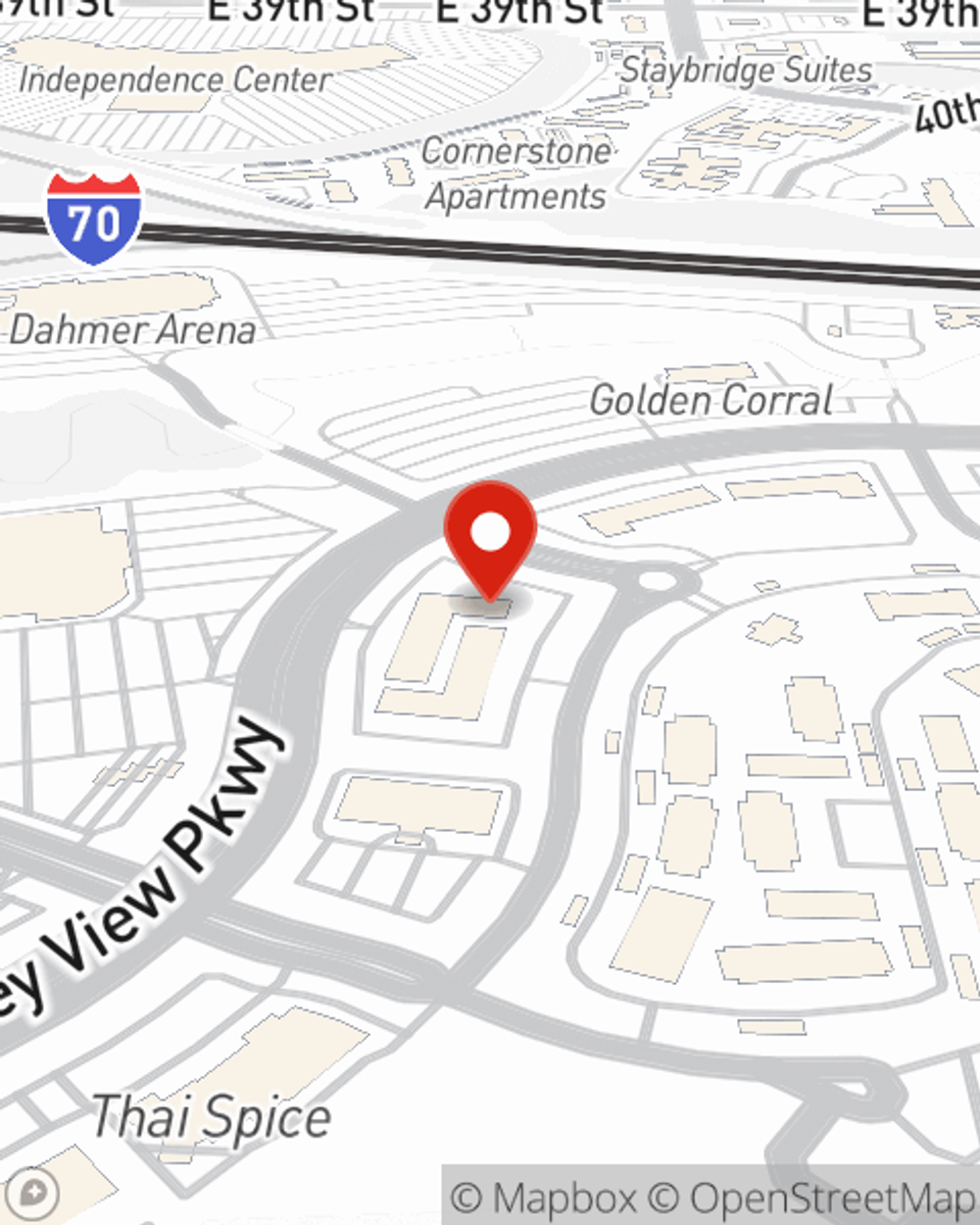

- Independence, MO

- Blue Springs, MO

- Lee's Summit, MO

- Lakewood, MO

- Grain Valley, MO

- Kansas City, MO

- Raytown, MO

- Bonner Springs, KS

- Edwardsville, KS

- Grandview, MO

- Oak Grove, MO

- Jackson County

- Johnson County

- Clay County

- Cass County

- Wyandotte County

- Prairie Village, KS

- Mission, KS

- Merriam, KS

- Shawnee, KS

- Lenexa, KS

- Olathe, KS

- Overland Park, KS

- Lafayette County

Help Protect Your Business With State Farm.

Do you own a gift shop, a veterinarian or a photography business? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on making this adventure a success.

Calling all small business owners of Independence!

This small business insurance is not risky

Small Business Insurance You Can Count On

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for artisan and service contractors, business owners policies or worker’s compensation.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Alicia Scott is here to help you identify your options. Call or email today!

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Alicia Scott

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.